Welcome to the November 25, 2008 edition of the investing carnival. There were a large number of submissions this week and I had to leave a few out in order to keep the carnival at a reasonable length. The articles were submitted over the course of last week. The tone of many of these articles seem to be predictive of the market bounce experienced the past two trading days.

Welcome to the November 25, 2008 edition of the investing carnival. There were a large number of submissions this week and I had to leave a few out in order to keep the carnival at a reasonable length. The articles were submitted over the course of last week. The tone of many of these articles seem to be predictive of the market bounce experienced the past two trading days.

Dividend Investing

Top dividend stocks with reasonable payout ratios (MagicDiligence - Optimizing Joel Greenblatts Value Stock Strategy)

Stock Analysis

A potentially huge reward with an asset play in Value Vision Media Inc (VVTV). (Old School Value)

An in depth analysis of Sysco Corp (SYY). (Dividends 4 Life)

Even Berkshire-Hathaway's (BRK/A) stock is suffering in this market. (Intelligent Speculator)

Is Baidu.com's recent decline a buying opportunity? (Intelligent Speculator)

Screening the Forbes Best Small Companies list for investment opportunities. (Old School Value)

Can Citigroup regain its footing? (Smart Money).

Smith & Wesson & Ruger-are they shooting blanks? (Tough Money Love » Hard Truth and Tough Love for Money Problems and Personal Finance)

The losers in the Volkswagen and Porsche merger battle. (My Simple Trading System)

Investing

A review of the book Investing for Dummies. Maybe a good read for all investors? (Living Almost Large)

Insight into performing fundamental stock research. (Finance-Information)

Financial issues impacting individuals beyond just the stock market. (KCLau's Money Tips)

A primer on the Price to Earnings ratio or P/E. (Investing School)

10 better investments than the market. (Learn The Stock Market And How to Trade)

More bold predictions from Jim Rogers. (Subprime Blogger)

Does one quarter of negative GDP growth equal a recession? (The Political and Financial Markets Commentator)

Inflation protection strategies for ones portfolio. (FIRE Finance)

Tips on staying afloat in this market. (Beating The Stock Market)

Reduce fund expenses with Vanguard Admiral shares. (Free Money Finance)

Investments for a depression like economy. (Zignals blog)

Advice on getting your investments back on track. (The Iconoclast Investor)

Investing through TreasuryDirect. (Wealth Junkies)

Is your 401(k) account safe. (The Digerati Life)

A review of the best asset allocation on a historical basis. (Ripe Trade)

When analyzing a company, read the footnotes in the financial statement. (Value Investing and Entrepreneurship by Qovax)

The importance of choosing the right asset allocation. (The Sun’s Financial Diary)

Value Investing

Obama's energy plan may benefit these stocks. (The Green Investing Blog)

Alternative Investments

Don't fall for stock option "get rich quick" schemes. (Michael James on Money)

Wealth Accumulation

10 steps to building ones wealth. (Money Blue Book)

Tips on saving money by reducing household expenses. (Money Blog)

If one consolidates their debt, they need to cut their expenses too. (Finance Tips 101)

That concludes this edition. Submit your blog article to the next edition of

investing carnival using the

carnival submission form. Past posts and future hosts can be found on our

blog carnival index page.

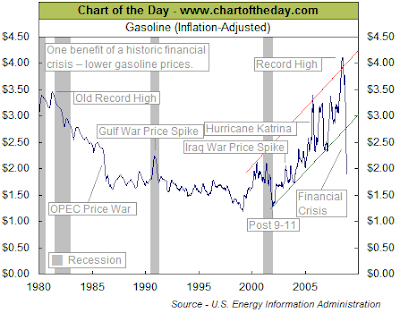

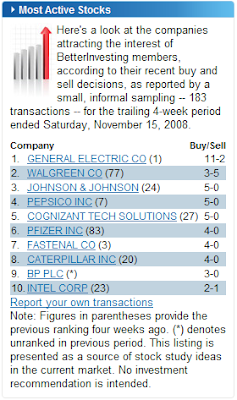

* image at beginning of post courtesy of CNN Money