As reported by the American Association of Individual Investors today, bullish investor sentiment increased nearly eight percentage points to 55.1%. This increase pushes the bullish sentiment level above the +1 standard deviation level and is the highest reported bullish sentiment reading since reaching 63.3% during the week of December 23, 2010. The sentiment measure surveys AAII's individual investors about their view of the market for the next six months.

|

| From The Blog of HORAN Capital Advisors |

Data Source: AAII

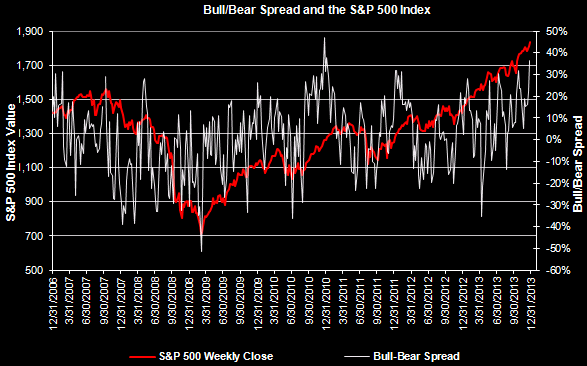

In addition to an elevated bullishness reading, the bull/bear spread has increased 37% and this spread is the highest since AAII reported the spread at 47% for the week of December 23, 2010.

|

| From The Blog of HORAN Capital Advisors |

Data Source: AAII

As noted in the past, these sentiment readings can be volatile from week to week. Included in the first chart is the 8-week moving average of the bullish sentiment reading and although elevated it remains below the level reached in December 2010. Importantly though, these sentiment measures are most predictive at their extremes and it appears the individual investor is certainly viewing the market in a more favorable light.

No comments :

Post a Comment