I was communicating with a client today who reminded me of a conversation we had five years ago almost to the day about whether or not the U.S. equity market was in a bubble. The discussion was prompted by the USA Today article,

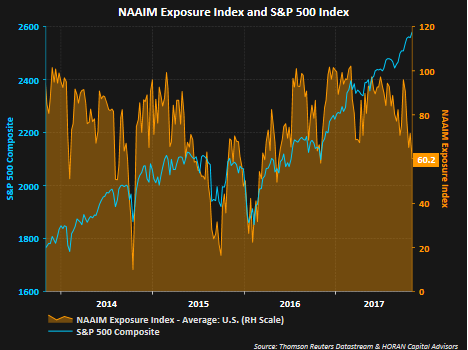

Consumer Sentiment Stat Hints that Bull Market May be Stalling Out, that highlighted a data point from the recent University of Michigan Sentiment Survey. In the survey it was noted that 65% of individuals surveyed believe stock prices rise over the next twelve months. This is a high level for the survey and a contrarian data point for stocks. The conclusion from that 2012 conversation was equities were attractive and our firm wrote as much in our

third quarter 2012 newsletter. Additionally, I shared a Fidelity white paper,

U.S. Equities: Light At The End Of The Tunnel. An interesting read in retrospect.

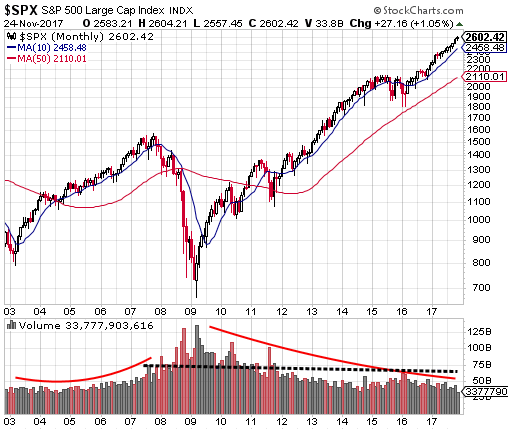

Much was occurring in 2012 with the 10-year Treasury yield below 2% and the Federal Reserve providing massive monetary support (QE) to the economy, i.e., buying $40 billion of mortgage bonds each month. This was occurring on the back of an equity market that was up 100% from the March 2009 low to June 2012. Both print and television financial commentary at the time was intimating concern for the markets.

Five years after 2012 to today and following all the consternation about bubbles, corrections and recessions, the U.S. equity market (S&P 500 Index) is up an additional 87% and the economy has avoided a recession. Certainly the period from 2015 through the third quarter of 2016 was a choppy one with the S&P 500 Index trading mostly sideways for almost two years. But so far in 2017, U.S. stocks seem to know only one direction and that is up, with the S&P 500 Index returning just under 13% on a price only basis with very little downside volatility

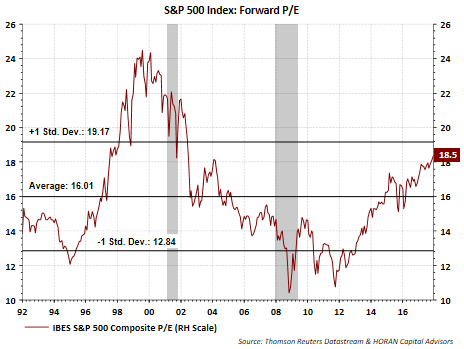

Raising the bubble question now is even more appropriate today then it was five years ago given how far the equity markets have risen over the last five years. Also, market data is decidedly different and is summarized below. Some of the data was taken from the earlier cited Fidelity white paper. If any variable in the below table jumps out at readers, it should be the higher valuation of the S&P 500 Index based on the price earnings ratio or P/E, 56.5% higher, while earnings are higher by only 17.5% during the same time period. In other words, the market advance over the last five years has largely been supported by multiple or P/E expansion. Sentiment data is also more bullish at the moment, but not at a level that has historically been associated with a bear market type downturn.

Certainly given current market valuation levels, earnings growth will be important for strong S&P 500 Index returns as we look ahead. Twelve month trailing earnings as of June 2017 does capture the energy weakness in 2012; however, when evaluating the year over year June 2017 to June 2018 estimated operating earnings growth rate for the S&P 500 Index, earnings growth is expected to equal about 18% and in line with the forward P/E. On a calendar year basis, comparing 2018 to 2017, earnings growth is expected at a respectable low double digit growth rate.

In a couple of recent posts I have noted the Fed's desire to actually begin withdrawing liquidity from the market and they announced as much in last week's Fed statement with a start date beginning next month. An old adage that gets repeated around Fed accommodation changes is, 'don't fight the Fed'. Just as the Fed has been supply liquidity since the onset of the financial crisis, and this has likely had some positive impact on asset prices, withdrawing liquidity can be disrupting on the way out. We will be on guard for potential asset price volatility, but will note, historically, stocks have been

positively correlated to the rate moves when they occur below 5%.

In summary, we were strongly bullish in 2012 given equity valuations and a high equity risk premium. We do not expect a recession near term, but believe today that more pressure falls on companies to generate earnings growth, which we do think is likely, but probably not a market where a rising tide raises all boats.

In client accounts we have reduced some equity investments where we believe earnings growth is more challenged and taken profits in some stocks that have moved higher and gotten ahead of valuations. At the same time, we have allocated equity investments to developed and emerging international markets over the last 18-months or so. This allocation adjustment has been a positive for clients and we continue to find valuations outside the U.S attractive.