The first six months of the year are nearly behind us so I thought it appropriate to provide an update on the performance for the 2017 Dogs of the Dow. As noted in the past, the strategy is one where investors select the ten stocks that have the highest dividend yield from the stocks in the Dow Jones Industrial Average Index (DJIA) after the close of business on the last trading day of the year. Once the ten stocks are determined, an investor invests an equal dollar amount in each of the ten stocks and holds the basket for the entire next year. The popularity of the strategy is its singular focus on dividend yield. The strategy is somewhat mixed from year to year in terms of outperforming the Dow index though. Over the last ten years, the Dogs of the Dow strategy has outperformed the Dow index in six of those ten years.

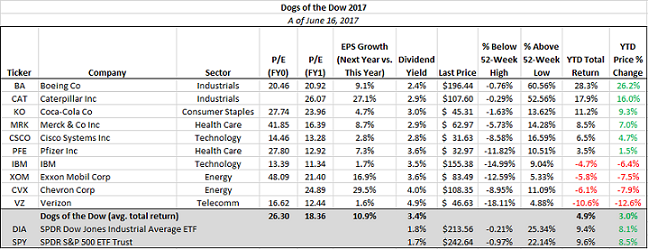

Since my last update a few months ago, the Dow Dogs performance has fallen further behind the Dow Jones Industrial Average Index. As can be seen in the below table, the average return of the Dow Dogs through 6/16/2017 is 4.9% versus the DJIA return of 9.4%.

Interestingly, in the top ten performing stocks in the DJIA index this year, only two are Dow Dogs, Boeing (BA) and Caterpillar (CAT). Boeing is the best performing Dow stock, up 28.3%. So far this year, energy has been a drag on the both the DJIA index and the Dow Dogs, while at the same time, industrial stocks have been performing well. In short, the sole focus on dividends in the Dow Dog strategy has yet to pay off this year.

No comments :

Post a Comment